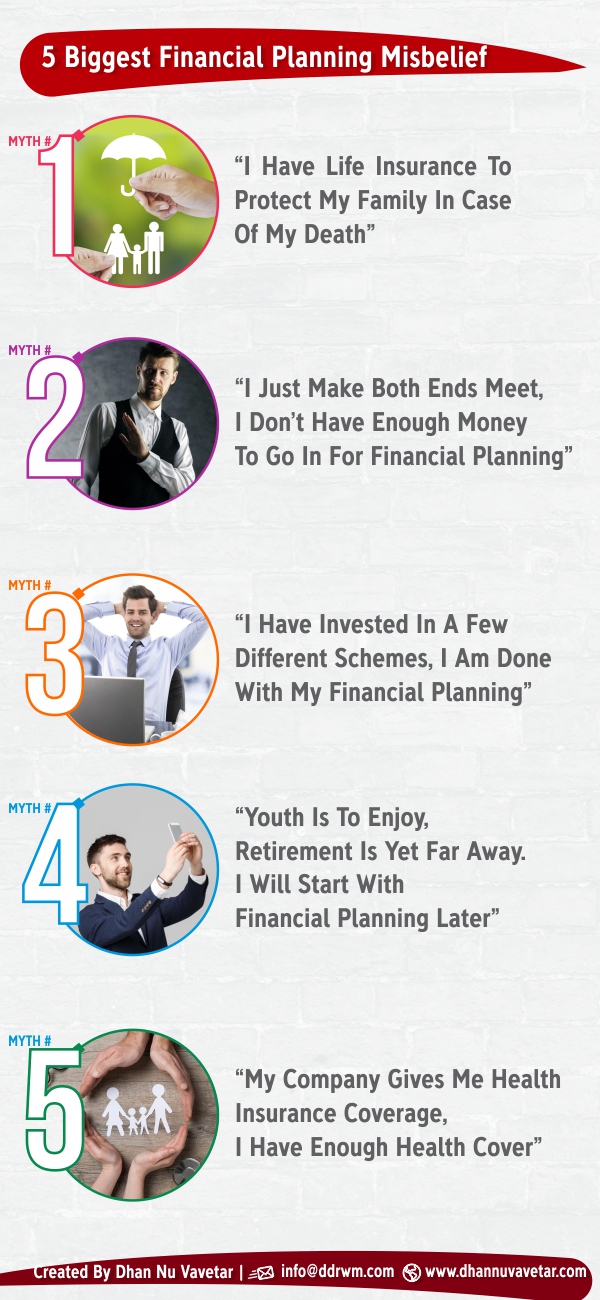

5 BIGGEST FINANCIAL PLANNING MISBELIEFS

The concept of financial planning may differ from person to person based on his beliefs and understanding. For some financial planning is not a priority, as they believe it’s too early to start with. For some financial planning is not a need as they have very little finances to manage their current cost of living. For some investing some amount from their monthly earning is quiet enough for their future living. There are some who assume that the company they work for pays their medical and hospitalization expenses so they do not need reserve funds for health insurance. There is also a class of people who believe that once they have invested their savings their task is done.

Moreover, the young believe that it’s too early for them to start with financial planning. This myth only complements the need for “no financial planning”. I have seen youngsters waiting to start with financial planning until they are almost on the verge of retirement. This leads them to live a dependent and low on confidence retirement life.

Well, friends, financial planning can never be overlooked and it’s a must, must for all as investments did today could provide for good financial resources in the future. It is true that a person who helps himself succeeds best in having financial stability in life.

Financial Planning Myths

MYTH #1

“I have life insurance to protect my family in case of my death”

Good going!!! My hearty congratulations for getting yourself insured and to protect your family needs in case of a mishap. Well, but the question is do you have adequate insurance to fund your family cost of living for a lifetime considering inflation? While you take an insurance policy it is very important to consider your current cost of living, add the inflation rate, number of dependents on you, cost of your children’s education, their marriage, your family’s health expense etc.

MYTH #2

“I just make both ends meet, I don’t have enough money to go in for financial planning”

“If you don’t find a way to make money while you sleep you will work until you die,” says Warren Buffett. We all need to be prepared for financial emergencies. We all need to put our hard earned money at work for us. Financial planning is not just for the rich or for people who want to repay their debts. It’s for everyone who has some of the other financial needs. We all need to identify our expenses, do budgeting, determine our financial goals, set a time frame, identify our risk appetite, and create a financial plan accordingly.

MYTH #3

“I have invested in a few different schemes, I am done with my financial planning”

Starting with investment is great. I appreciate you for taking the first step towards an ongoing journey. However, believe me, financial stability is a lifelong journey.

You need to understand your financial goals, your current cost of living, your risk appetite before you feel “it’s enough”. You need to review whether the schemes you have invested in are really performing or not? It is also important for you to understand whether the funds you have invested in are sufficient to fund your financial goals by adding the rate of inflation.

At Money Multiplier, we not only help you plan your investments but we also help you determine your financial goals, time horizon, your risk appetite, your financial circumstances, and how much you corpus will you need to fund your financial goals.

MYTH #4

“Youth is to enjoy, retirement is yet far away.

I will start with financial planning later”

Let me tell you, it’s not just a myth but one of the biggest mental blocks that restrict people from starting with investments for financially healthy retirement.

Retirement I believe is not a contingency; it’s an inevitable stage of life, which will come in almost each of our lives. And hence, planning for retirement is a need, it’s a necessity.

One of the thumb rules of investment suggests start early, reach safely. When we begin investing for our retirement at a young age, we have time by our side, we are in the position to take high risk and grow our money.

MYTH #5

“My company gives me health insurance coverage, I have enough health cover”

Being covered with health insurance and medical expenses at work is good, but do you really think it is sufficient? Is it enough to cover all your health expenses?

Well, the reply is No!

With the present lifestyle, being young does not prevent you or your family members from getting a critical illness. With the increasing inflation rate and cost of hospitalization, it is always good to take additional health coverage for a critical illness that involves the cost on quality treatment, maintaining the lifestyle of the family, cost of hospitalization, until one is ready to go to work.