MISTAKES WORTH AVOIDING IN RETIREMENT PLANNING

Retirement is one of the most crucial stages of life. Be it personal or financial standpoint, leading a comfortable retirement life is a widespread process that takes sensible planning and years of determination.

If you belong to the school of people who think investment during your working life is sufficient enough for the second innings of your life – retirement. You are highly mistaken. By believing so, you will fall into the trap of inflation. Meaning, you will not have enough corpus to be able to continue your present use to lifestyle after your retirement or once your earning power stops.

Unclear goals, I believe, leads to setting unrealistic goals. Hence, it’s very essential to be clear about your desires and aspirations and to set realistic and achievable goals.

With evolving technology and advanced healthcare facilities, life expectancy has increased considerably. Today, people live 25-30 years, even more, after retirement. In such a scenario, it is imperative to ensure that your finances are in a good shape and simultaneously growing when you retire.

So, let’s talk about a few most common mistakes investors make while planning and investing for their retirement.

STARTING LATE

I have often observed, the young ones believe it’s too early to start for retirement planning, in the mid-age people are loaded with responsibilities, and when they are about to retire they realize it’s too late to start. Retirement often comes at the end in the financial planning list.

The focus is always, instead, on intermediate goals than long-term goals. I have seen people saving for a luxurious dream car they want in the next three-four years or a lavish house they plan to buy in the next 10 years. Surrounded by ever-growing needs, misunderstanding desires with needs, they often tend to forget retirement planning. Believe me, it is absolutely a wrong approach towards financial planning.

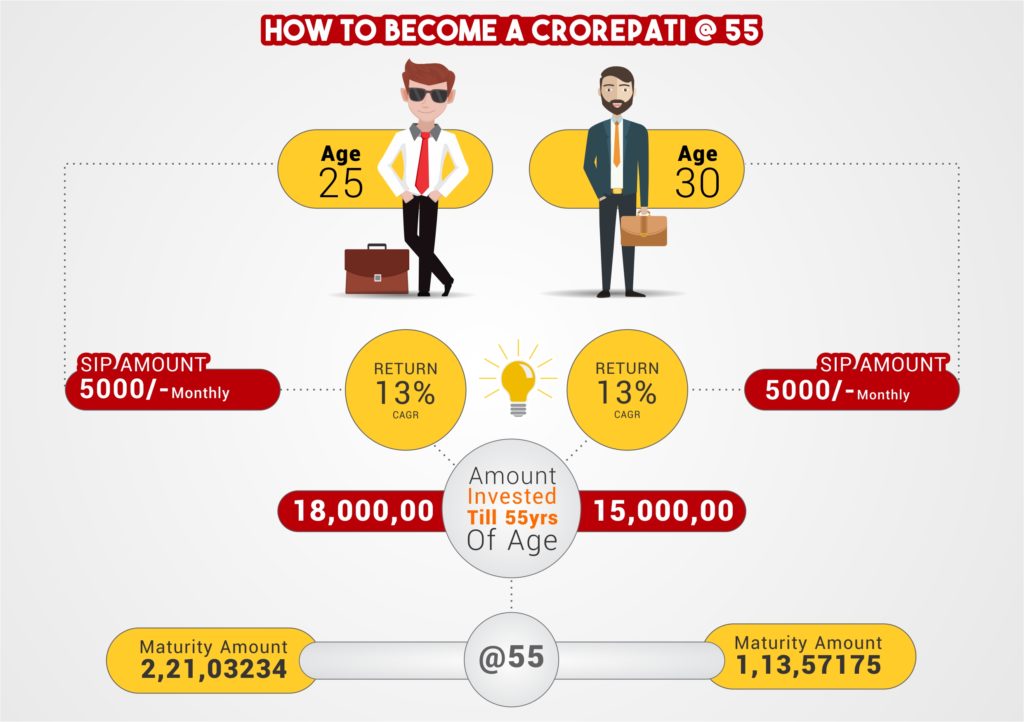

Starting early has its own advantages. By doing so, your money gets time to multiply. Each gain stimulates further returns. However, when you start late, you miss out on the benefit of compounding.

Let’s study an example of Jai &Veeru –Jai started saving Rs 5,000 per month at 20 and earns 12% returns every year, he will have Rs 5.94 crore when you retire at the age of 60.

On contrary, Veeru started at 30, he will be able to accumulate just Rs 1.76 crore.

The 10 additional years that Jai gave his money to multiply will do wonders for his financial wellbeing.

The more you delay, the more you will have to save per month. For example, if your age is 20 and you want Rs 5 crore by the time you are 60, you will have to save just Rs 4,207 a month for the next 40 years, assuming that the rate of return is 12%. If you delay till 25, you will have to almost double your savings (Rs 7,698 every month for the next 35 years).

Financial planners are of the view that investors who don’t start saving early tend to make riskier investments choices later in life.

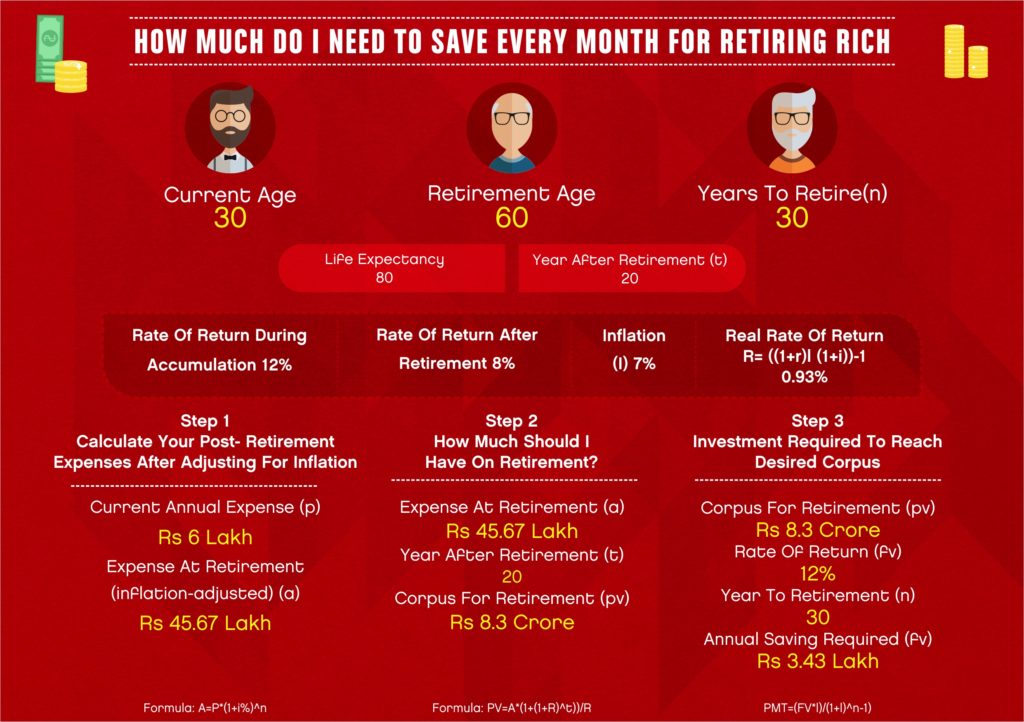

What to do: First things first, determine your current cost of living based on which determine how much money you would require to fund your use to lifestyle post-retirement.

Once you arrive at the figure, move on to implement your investment plan. It is always suggestive to take investment expert’s or financial planner’s help.

If you have started saving for your retirement late, in your 40s or 50s, it is suggested to delay your retirement by a few years. Rethink over your investment strategy try to allocate more into equities instead of fixed deposits or bonds, depending on your risk appetite. As equities promise much higher returns as compared to any other investment assets.

IGNORING INFLATION

Inflation is a demon that comes down hard on anyone who ignores it. Since retirement is a long-term investment goal, it is important to understand the impact of inflation on your other financial goals like child education planning, marriage, buying a house or a car etc.

Inflation substantially reduces purchasing power. Assuming 7% inflation, Rs 1,00,000 today will be worth Rs 13,000 post 30 years. Hence, it’s crucial to consider inflation as invest for your long-term financial goals. Your investments should hold the capacity to beat inflation, that is, generate returns that are at least a 5-10% of percentage points above the inflation rate.

Taking inflation into consideration will not only determine how much you have to save but also help you pick the most suitable investing strategy as per your financial goals.

What to do: If you have ignored price rise while doing the maths, revisit your numbers and plans. Take the realistic rate of return (minus inflation) while doing the calculation. You can take an average 7% rate of inflation.

WITHDRAWING PROVIDENT FUND MONEY

Many people withdraw money from their provident fund account. Believe me, it’s altogether a wrong move, as instruments like Provident Fund are exclusively designed to provide financial security post-retirement. These instruments are highly useful for retirement planning, especially due to their tax benefits.

Often people ask me whether it is okay to withdraw money from the PF for buying a house or it’s better to take a loan. Mysay, let the PF rest for post-retirement.

What to do: Do not withdraw from your PF account. If you are short of cash, delay the purchase till you are able to save more, but do not touch your PF account pre-retirement.

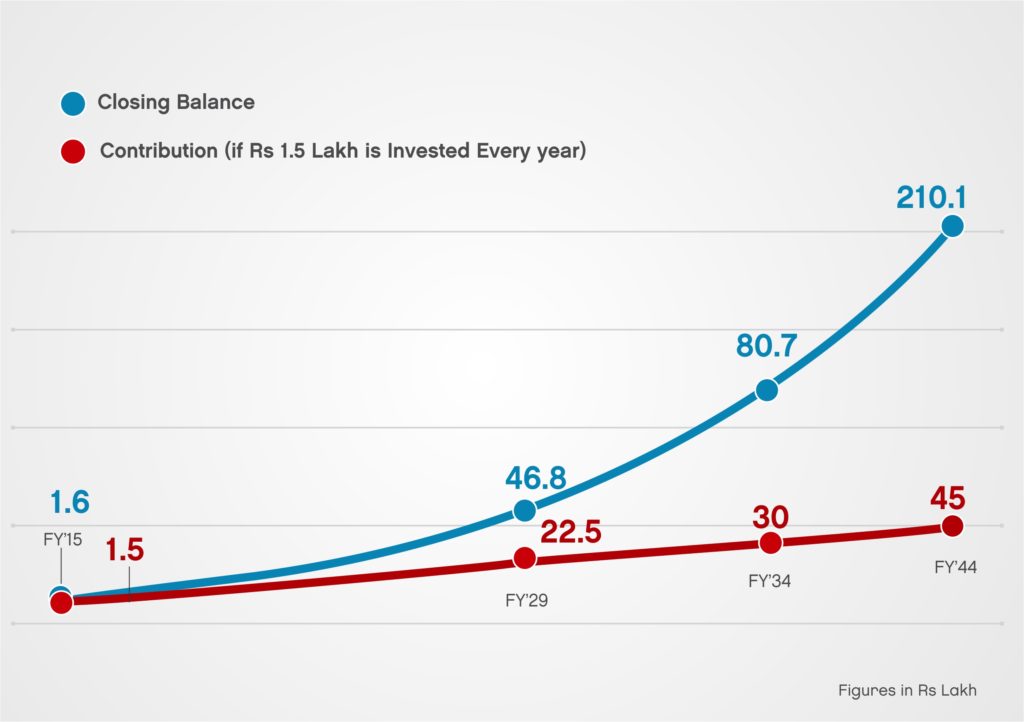

High-interest rates offered by fixed deposits, mutual funds, and equities may attract you. But remember, that you pay tax on interest earned on fixed deposits, gains from mutual funds and other investment instruments. On contrary, return generated from your provident fund account is tax-free. Also, PF investment is entitled to a deduction under Section 80C of the Income Tax Act.

If you invest Rs 1.5 lakh every year, you can save Rs 46.75 lakh in 15 years and in 30 years; the amount will accumulate uptoRs 2.10 crore.

What to do: PF account is a must in your investing portfolio. There is no substitute for it. The 15-year lock-in ensures that you save just for old age without getting swayed by midway goals.

DELAYING HEALTH INSURANCE

Medical expenses rise as a person ages. Experts say many people don’t buy individual health plans during their working life as they are covered by employers. This is wrong as most employers give the cover only until you are employed with them.

You also have the option of porting the employer’s policy to individual cover at retirement. But experts say do not depend on group policies after retirement as employers keep changing insurers and so you may miss out on benefits accumulated in the earlier policy such as waiver of the waiting period for pre-existing diseases.

It is good to buy an individual health policy early in life. It is not only cheaper but also helps you cover pre-existing illnesses after the completion of the waiting period. Moreover, it covers you even after you leave the job or your company curtails the benefits under the group plan to cut cost. It also earns tax benefits up to Rs 15,000 for individuals and Rs 20,000 for senior citizens.

What to do: A single hospitalization can wipe out your savings. Buy health insurance early in life. It will help you save a lot of money. Second, ensure that the cover is adequate. Estimate your needs on the basis of the cost of treatment and inflation. If you cannot afford a large cover, buy a regular plan with low sum insured and add a top-up cover. Top-up plans are cheaper than regular plans. In a regular plan, the insurer pays up to the sum insured. A top-up plan covers you after a fixed amount, called deductible, is crossed.

NOT PLANNING FOR EMERGENCIES

Your long-term investments are not for meeting emergencies. Hence, all people, irrespective of age and employment status, must build an emergency fund.

Ideally, your savings should guarantee you a lifestyle after retirement, which is the same as you enjoyed in your working years. This involves high-level contingency planning as your income streams dry up as you retire.

What to do: A contingency fund should be able to meet at least six months’ expenses. In later years, it should take into account possible medical emergencies as well.

NOT HAVING ENOUGH MONEY FOR EARLY RETIREMENT

Stress is nowadays burning out people at a young age, making them think of retiring early. Financial planners say they come across many people who want to advance their retirement age. But most of the time they advise them to delay the plan if they do not have enough funds to last their lifetime. Early retirement requires rigorous planning for meeting life’s goals.

To help you ascertain how much money you will need at retirement, we have prepared a table, How much do I need to save for retiring rich?

What to do: Compounding is a powerful tool (the longer the period, the more the money will grow). If you think you will start saving later when your income rises, you may not be able to save enough. Therefore, enlist a financial advisor, start immediately, evaluate the available savings and protection instruments, calculate the funds required and get down to executing the plan.

PAYING HIGH FEES

Before investing in a financial product, look at costs such as the agent’s commission and fund management charges. This is because these fees are paid from the money that you will invest. The higher they are, the lesser will be the amount invested. You can lose lakhs if you are not careful.

Consider this. You will end up losing Rs 5.82 lakhs over a period of 30 years if you invest Rs 1 lakh in a mutual fund scheme with 1% extra fund management charge, at an assumed rate of return of 12%. “Low cost does decide returns. Hence, the best investments on the basis of cost are mutual funds, exchange-traded funds, stocks, PPF and tax-free bonds. One must avoid traditional insurance products such as endowment & money back and Ulips.

What to do: Look closely at costs. For instance, for mutual funds, compare fund management charges. One option is to go for direct plans. In these, instead of going through a distributor, you invest directly with the fund house. Since there is no distribution fee, the expense is lower. A comparison of annual returns given by direct and regular plans shows that direct plans of diversified equity funds outperform the regular ones by more than 1%. Similarly, while buying insurance, go for online plans. The National Pension System is also a cost-effective retirement tool.

NOT HAVING ADEQUATE INSURANCE

When a bread earner dies, the whole family suffers a setback. A life insurance policy can take care of the family’s well-being in such a case. The question is, how much cover one should have?

The ideal figure, say, experts, is at least 10 times the annual salary. This will give the family a cushion of ten years to adjust to the new financial reality. For example, if your salary is Rs 10 lakh a year, the cover should be at least Rs 1 crore.

Another approach is calculating the human life value, that is, the present value of your future income. Don’t forget to factor in liabilities such as home loan while doing the calculation.

What to do: Buy a term insurance policy as soon as you can. Buy online to save on premium. And do not forget to increase or decrease the cover as your liabilities change.

WRONG ASSET ALLOCATION, IGNORING EQUITY

It is important to invest in the right assets. Asset allocation is to invest what oxygen is to human life.

As per a study, 91% performance of a portfolio is linked to asset allocation. Selection of securities, timing, and others account for the rest 9%. Right asset allocation is important as every asset goes through different cycles of boom and bust and has a different risk-return profile. Diversification is needed to optimize returns.

Another mistake is being conservative and ignoring stocks altogether. Keep in mind that to beat inflation one does not have any option but to invest in a growth asset like equity, which can give good returns over the long term. For example, Rs 100 invested in the BSE Sensex in 2000 had become Rs 422 by the end of 2013. Don’t forget that this period covers both the dot-com bust and the 2008 financial crisis. The same investment in G-secs or government securities would have become just Rs 242.

Stocks can also help you reach your goals before time. Experts, in fact, say that those who have already retired should also have some exposure to stocks to support their cash flow as it is not possible to earn inflation-beating returns with debt investments.

Most retired people think that as they do not have a big income stream, they should focus on capital preservation and invest in fixed deposits. However, they must appreciate that they have 25-30 years ahead of them. Some exposure to stocks can shore up returns.

What to do: We are not saying that you should invest all the money in stocks. Debt plays a very important role in the portfolio by providing it stability. Gold, too, has delivered good returns in the past decade. The key, according to experts, is to go for the right asset allocation.

The allocation between debt and equity will depend upon one’s risk appetite. Generally, the older the person, the lesser risk he must take. One thumb rule to decide the equity allocation is “100 minus age”. But this may not work in many cases. For instance, a retired person with no obligations and sufficient funds to meet his day-to-day expenses can consider a higher exposure to equities.

Age must not be the only parameter. Risk appetite, liquidity, inflation, liabilities, and goals should also be taken into account. But one thing is clear. Equity investment has been for the long term.

So, the more time you have to retire, the higher exposure you can have to equity.

ASSUMING COST OF LIVING WILL GO DOWN SIGNIFICANTLY

I have often seen people even if they invest for their retirement they fail to match the expenses. Why? Simple reason being, they do not calculate their current cost of use to lifestyle, they do not calculate the price rise, they do not plan their lifestyle after retirement, and so on. To summarize, they fail to take a holistic approach towards retirement planning.

With no doubt expenses like children’s education, loan equated monthly instalments and daily commutation curbs to a large extent, but at the same time expenses such as medical and payment to domestic helps also rise to a considerable extent.

What to do: Take a holistic approach towards planning your retirement. Consider expenses like domestic help, healthcare, taxation, desires you have pushed to enjoy post retirement etc.

UNDERESTIMATING TAX OBLIGATIONS

Often investors forget to calculate the obligations. It is very essential to calculate the taxes you may be liable for even from the income generated from your investment, like the pension.

What to do: Invest in assets with fewer tax obligations. You must look at asset class, which provides income with tax benefits on maturity/withdrawal such as provident fund.

UNREALISTIC RETURNS

Those who invest in shares expect whimsically high returns. It is always better to be realistic in your expectations. For a simple reason being, the performance of your investment is not in your hands or cannot be predicted, especially in the case of equities. Stocks do deliver amazing returns, but the risk of losses is also equivalently high.

However, investment holding in equity should always be in the long term. One can assume approximately 15% of return a year over the long term.

What to do: Risk and returns are always co-related. Understand your risk appetite, your holding capacity, and financial goals before you invest in equities. Diversify your portfolio. It is also advisable to not to invest all your money into equities alone. Pick investment assets as per your financial goals and cost of living.