ASSURED WAYS TO OVERCOME MONEY CHALLENGES

Amongst the most common mistakes an individual do with finance is not taking thoughtful spending and investment decisions, not having a well-planned budget in hand, not determining your current financial status, apart from not having a personalized financial plan. Irrespective of how good your investment choices are if it does not goes hand-in-hand with your financial goals or budget, you’re simply inviting trouble.

Moreover, one of the most common mistake that an individual does is they stay highly dependent on single income their Earning Power. They forget to make investments (diversified) as their second source of income.

“Never depend on single income. Make investments to create a second source”. – Warren Buffet

Be it designing your interiors, starting your business, or investing, we need to carefully design a blueprint based on our future financial goals before taking on a challenging task. In fact, the more important the goal (for instance – child education planning), the more prominence we need to place on careful planning.

Unfortunately, I have seen individuals with the “we’ll plan out the details as we go along” attitude when it comes to building a secure financial future.

We all live in a physical home, it gives us a sense of security and protection. Similarly, we all live in a financial home that’s built by our past financial and investment decisions. Now just like a lack of planning and finances may lead to a poorly designed house, so is the case with our financial home. I have seen people; they reach their retirement and find their financial home isn’t the way they’ve desired. It lacks security and the sense of protection. Why?

Simply because their lifetime of investment decisions were unplanned financial decisions, it lacked a master blueprint.

Let’s make sure it doesn’t happen to you. Let’s set aside time to create a personalized financial plan that’s designed to build the kind of future financial home you’ll enjoy living in.

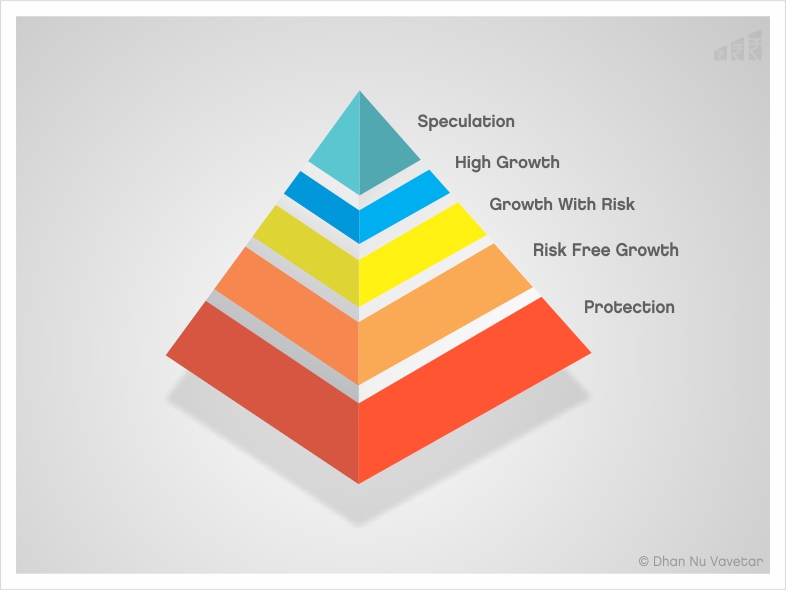

Now, let’s take a pyramid for an instance. A financial pyramid dictates how money should be divided for different financial goals based on its time frame and risk capacity.

FINANCIAL PYRAMID

Once you understand financial pyramid you will effectively understand the financial planning process.

The base of the pyramid is PROTECTION. This can be achieved through insurance, will, and power of attorney, debt reduction, emergency savings.

The stage two of the pyramid is LOW-RISK INVESTMENTS. This includes investment instruments that involve low risk such as debt funds, balanced funds etc.

Then comes HIGH-RISK INVESTMENTS. This includes investment options that involve high risk such as mutual funds, equity, real estate, etc.

Fourth Stage and the highest in the hierarchy is SPECULATION. This stage helps you create wealth.

Before we begin with understanding how can we create wealth for the important junctions of our life let’s list our goals, consolidate and refine them, prioritize them, define the time frame, and make them measurable. Once you have defined your goals, create a budget.

Budget is the wind that will help you sail, however, your goals are the compass that will navigate your planning.

Don’t save what is left after spending but spend what is left after savings. –Warren Buffett

Believe me, having a budget and a plan for investment is very crucial, but equally important is to have a spending budget in place. Without having a spending plan, you really can’t implement investing strategies. Having a budget ensures that you will always have enough money for the most important things and stages of your life – e.g. investment for your retirement helps you live a respectful and confident retirement life.

A budget helps you to divert your money; it tells you that the extra money left over each month should be saved for those once-a-year items or for some long-term goals.

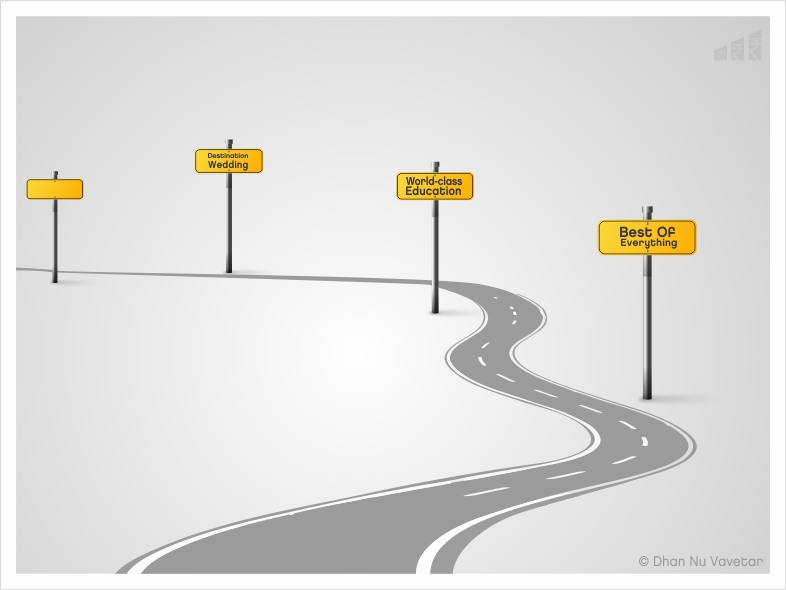

CREATE A ROADMAP. IT WILL HELP YOU KEEP A TRACK OF YOUR FINANCES.

Once you create your first budget, implement upon it and experience how it can keep your finances on track. By creating a thoughtful budget you can easily forecast which months your finances might be tight and in which months you’ll be having extra money to invest for your financial goals. You can then take measures to even out the highs and lows in your finances to ensure things can be more manageable or as per planning.

Long-term budgeting also allows you to forecast how much money you will be able to save for important things like your dream vacation, an all-new luxurious car, your first home or second home, emergency fund or your retirement planning.

Using a realistic budget to forecast your spending can help you with your long-term financial planning. You can accordingly plan out your annual income and expense plan for long-term financial goals like seed capital for your business, buying property or early retirement, planning your dream vacation, planning for your child’s education etc.

With no second thought, there is no one-size-fits-all financial plan, however certain experiences are common to particular phases of life. So ensure to personalize these to your individual circumstances.

PEOPLE IN 20’s & 30’s

Returns on Investment highly depend on the age of the investor, time horizon, risk tolerance, and their financial goals. With young investors they have a considerable time on their side – hence, there are extensive investment avenues available to young investors like equity, mutual funds, ELSS, insurance, PPF etc. However, it’s very essential that the young investor is associated with the right investment advisor. A right financial planner can help to bridge the gap between young investors achieving or not achieving his financial goals.

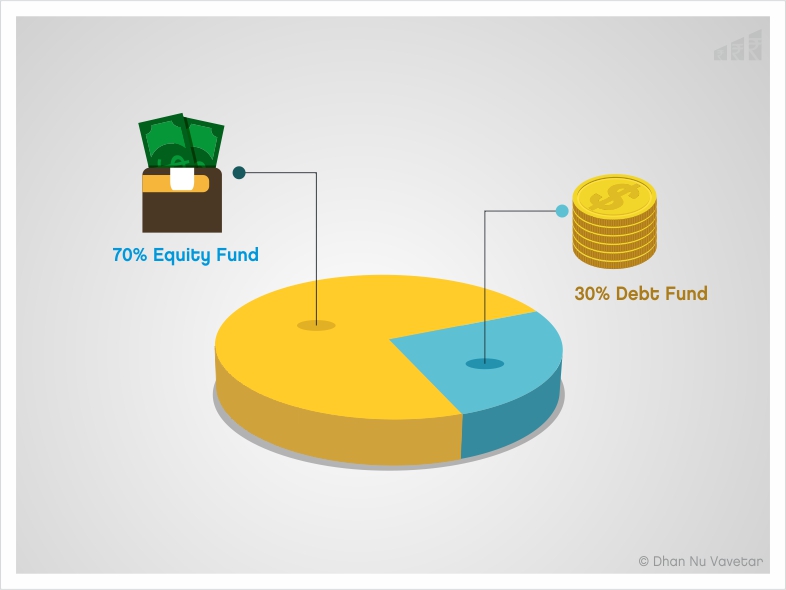

As a golden rule of investment, a person shall invest 30% of his portfolio in debt equal to his age and the remaining 70% in equity after providing for sufficient amount.

Being young and having time by their side and having high-risk tolerance, they can plan from basic needs to higher goals this includes buying a house, a dream car, retirement planning, marriage planning, wealth creation etc. It is always suggestive for young investors to pump their money in equity and equity related instruments and fewer amounts in debt.

Young investors often fall prey to unwanted expenses. They fail to plan for their needs. They don’t value the importance of investments or starting early.

Investing a small amount in a systematic and disciplined manner can help them build wealth over a longer period.

Here’s is how to go about investing for young investors –

#1 MAKE A BUDGET

Creating a budget is a thoughtful process. It requires tracking your expenses to ensure your budget is realistic and encompasses your income and expenses. While you design your budget, determine your short and medium-term financial goals. Evaluate your budget; is it full proof to realize your goals? Implement it to achieve your goals.

#2 AVOID DEBTS ON DEPRECIATING THINGS

Make a list of your debts. Generally, there are two approaches for debt-payment –

- Pay off your highest interest rate debt first. This can be an ideal approach if you are highly disciplined. It will help you to save the most money in interest expense.

- On contrary, the second approach is paying off the debt with the lowest balance

#3 BUILD EMERGENCY FUND

It’s always a good idea to start saving a small amount as an emergency fund. Having a small savings account will help stay prepared when unexpected expenses arise.

#4 PLAN FOR YOUR RETIREMENT

One of the golden rules of personal finance planning is starting early. Starting early helps you to keep time by your side. Investing even a small amount systematically and in discipline can lead to the huge corpus in the longer term.

Well, it might be a little controversial if you are in debt, in this case, you should skip this step for a time being.

#5 DEFINE YOUR INVESTING STRATEGY

Whether you’re investing in equities or Debts, you need to have a well-defined strategy in hand Money Multiplier offers smart investing strategies to help you meet your financial goals. Our investment strategies are designed on the core principles of personal financial planning.

PEOPLE IN 30’s &40’s

According to renowned investor Warren Buffett, one must invest in places one knows best. The mid-30s mark a financial turning point from high spending to high saving. It’s catch-up time now for accumulating enough surplus for important junctions of your life – child education, retirement planning etc. Your priority list might include:

#1 REVISE YOUR FINANCIAL BUDGET

Although budget revision is an annual event, it should be considered in between if in case you haven’t modified your budget in a while. Take a fresh look at your financial goals as well. If you’re serious about meeting your defined financial goals, you really don’t have as much of a time as you once had.

#2 INVEST IN LONG-TERM

Although there are short-term as well as long-term investing instruments available. It’s always suggested to invest in long-term instruments. If you keep going in and out of the market, you may stand to lose.

#3 MAKE A PLAN OF ACTION

It might happen that you spend a lot in a certain month, curb your spending in the next few months to make up for it. Make a simple investment and expense plan without delay. Don’t push it to the next month. If you believe that this month it’s going to be different, believe me, it never will.

Plan your expenses – your outstanding debts, as well as the upcoming needs like school payments, new car, home repair etc. At this stage of life, your focus should be accumulating as much corpus as possible for the important junction of your life, including an emergency fund. Make every attempt to do away with your debts. If you haven’t already done so, pay off your credit card balances, car loans, and other debts.

#4 GET REALISTIC ESTIMATES OF THE CORPUS YOU WILL NEED TO FUND YOUR USE-TO-LIFESTYLE AFTER RETIREMENT

Money Multiplier’s Retirement Planning Calculator can help you with to successfully accomplish this task, as can many other good calculators available at other financial sites.

With specific figures in mind and proper investment planning, you can achieve your goals. Systematic Investment Planning is something financial experts harp on.

#5 REVIEW YOUR FINANCIAL PLAN

A sound investment plan is nothing but striking a perfect balance between your assets and liabilities. A successful financial plan is the one, which ensures you have the right assets at the right time.

However, it’s important to understand that making a financial plan is not the end of the story. You need to review it frequently and stick with the plan, it is even more important.

#6 MAXIMIZE YOUR RETIREMENT PLAN

Retirement planning is not just about having enough money to fund your lifestyle. It involves other aspects as well – your health cover, insurance plan, having enough corpus to fund to fulfil your responsibilities after retirement and to lead respectful and confident retirement life. Convert your savings into income.

PEOPLE IN 60’s

And the big day arrives. Retirement may mean freedom from work, freedom from hectic schedules, freedom from the job, but with this freedom comes the unsettling loss of getting the regular paychecks.

Don’t panic, you can have peace of mind by making sure your personal financial plan reflects these major changes.

Here are the key points that need to be considered:

#1 REVIEW WHETHER YOU HAVE ENOUGH CORPUS TO FULFIL YOUR USE TO LIFESTYLE

Each one of us has set a standard of living. It’s very important to make provision to continue the same standard of living even after your retirement. This will help you lead a life with respect and confidence.

#2 RE-CREATE YOUR BUDGET

Retirement is not just about planning your finances, but it’s about planning your lifestyle. It’s about matching your living expenses to the amount and timing of your income.

#3 PUT YOUR MONEY AT WORK

Now that your income has stopped, it’s very important to convert your savings into income-generating investments. So, how do you approach your investment now? When it comes to investing in retirement, experts say there is one golden principle – invest wisely and safely. To begin with taking a look at three factors – the sources of your retirement income, the flexibilities of your budget, and your risk tolerance. From here on you can lay the structure of your portfolio based on an asset allocation strategy that places a high priority on safety.

Retirement is a time to reduce risk, taking only as much as is necessary to meet your financial needs. Even if you’ve been an “all stocks, all the time” investor throughout your life, it’s foolish to take that added risk if you can live comfortably on the income provided from less aggressive investments. So look closely at what your specific income needs are, and throttle down your risk if you’re able. The new SMI Managed Volatility Fund may be a useful tool for the stock allocation of those at this stage since it attempts to offer some downside protection while still pursuing the Upgrading strategy.

CONCLUSION

I’ve touched on some of the most crucial aspects of creating your personal financial plan, identifying your season of life and risk capacity both practical and psychological, identifying your asset allocation, and so on.

The article highlights key items to address in your personal financial plan at a different stage of life. Ultimately, your financial goals and priorities can only be decided by one person, that’s you.