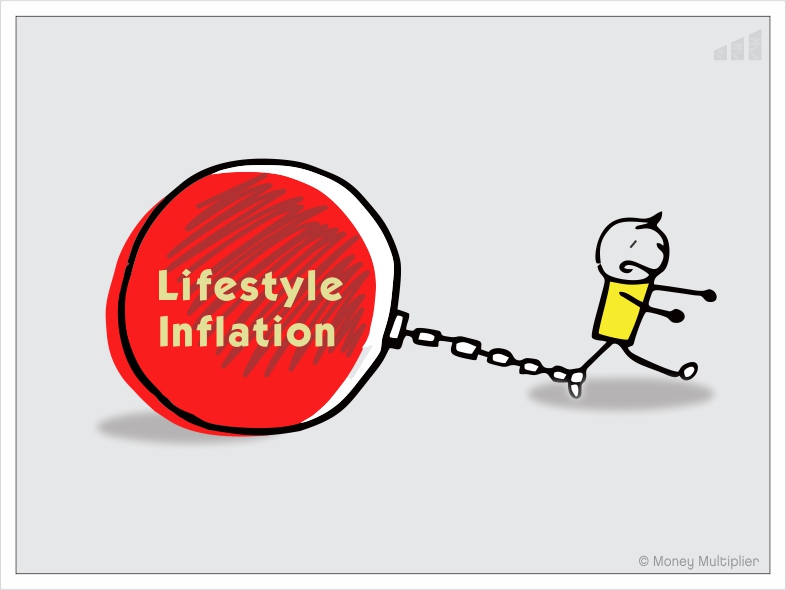

WHAT IS LIFESTYLE INFLATION?

Lifestyle Inflation means increased expenses as income rises. Imagine getting a new job or a performance bonus, or getting unusual business profits or simply moving from dependent life (student) to independent life (employment) – such instances can spurt Lifestyle Inflation.

There are ways to ensure you don’t succumb to Lifestyle Inflation and how can you confront this silent wealth destructor.

FINISH OFF THE LOANS

Whether it is an outstanding loan or a credit card bill, it must be cleared at the earliest.

INCREASE INVESTMENTS

The new or additional income should straight make way to thoughtful investments.

INVEST IN PERSONAL DEVELOPMENT

Consider investing in yourself and your personal development, it will help you to upgrade to new skills, which might help you to boost your career graph.

SET A BUDGET FOR YOURSELF

Prepare a pre-defined budget to combat lifestyle inflation. In doing so, you need to differentiate between your needs and desires.

STAY AWAY FROM THE PEER TRAP

Peer pressure has a lot of influence over lifestyle inflation. Make sure you don’t fall in the trap of imitating your peers rather focus on your needs.

PLAN FINANCIAL FREEDOM

Having the ultimate goal of financial freedom can set you on a prudent path. It will help you to eliminate all unnecessary expenses and focus on your financial goals.

Deepak Dhabalia

Wealth Coach