ARE YOU WELL EQUIPPED TO FIGHT BACK THESE 4 FRIGHTENING FINANCIAL SITUATIONS

No one knows what the future has in the fold for us. We wake up every morning wishing the best for our families and ourselves. We do our daily chores, go to work, and strive hard for a better and successful future. However, certain personal, financial and social circumstances may affect our families and us severely.

But not if, yes not if your finances are well planned. Smartly planned finances can help you endure tough times. And in doing so, it’s always suggestive to have a financial health check. Let’s see how well prepared are you for following terrifying What If… financial situations.

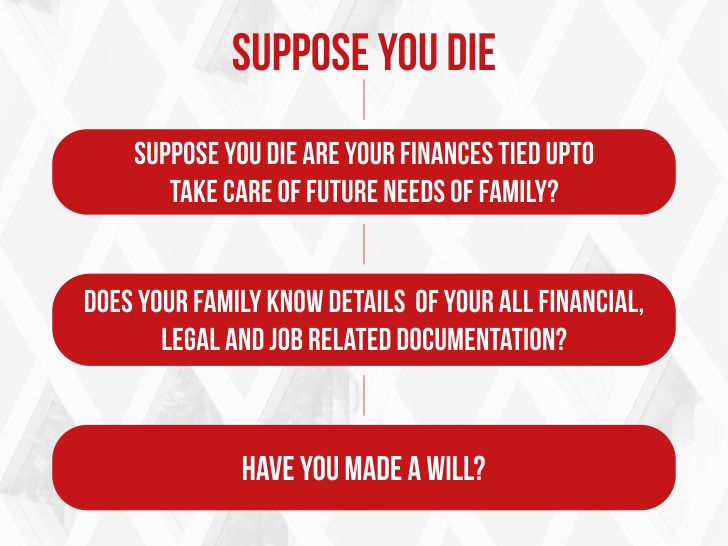

What If You Die?

Let’s begin with the most feared yet certain event death. Are your finances well planned to fund the cost of use to the lifestyle of your family in your absence? Are you sufficiently insured? Is your family informed about the details of all your financial and legal documentation? Have you made a will yet?

As the bread earner, your responsibility doesn’t end with earning money for a present, it just begins with it. There is a bunch of questions to ponder upon. You need to financially protect your family for a present as well as even after your death. Keep all your financial and legal papers well documented; also it’s important to keep your family members in the knowledge of all your dealings.

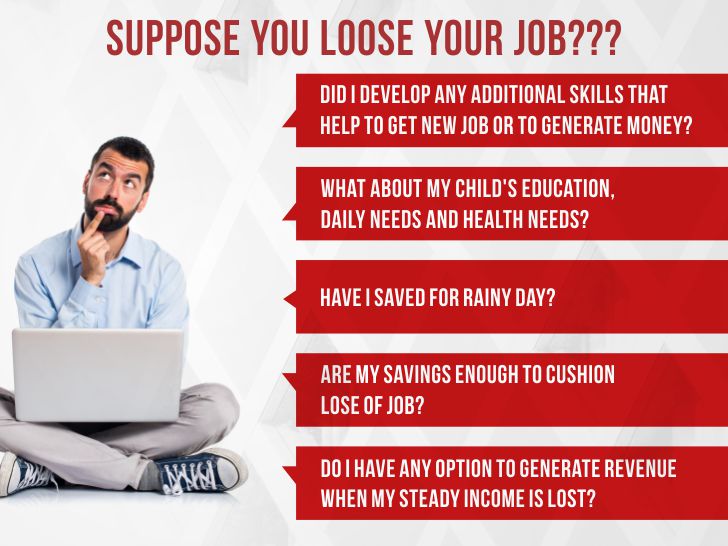

What if you lose your job?

In the present economic scenario, simply the fear of losing your job condenses a feeling of depression and worthless. It throws life completely out of gear.

What if… Do you lose your job? How will your family survive? How will you fulfil your liabilities and a whole lot of responsibilities? Have you built enough corpus to fund your children’s education? Have you built enough corpus to fund yours and your family’s health needs and cost of use to a lifestyle? Are you financially equipped to survive for a few months without paycheques? Do you have an alternative source of income to generate revenues when your steady source of income is lost? Have you created an emergency fund?

What if you need an XYZ amount all of a sudden?

As a financial advisor and money multiplier, I would strongly recommend you to determine your current cost of living and then to maintain a reserve of three months at least of that cost of living in your savings account, fixed deposits, or any other liquid funds that you can utilize that amount as and when required.

What if you were to be hospitalized?

Hospitalization today seems to be a certainty and a costly affair. Studies reveal Blood Pressure, Diabetes, Heart Disease and Cancer are hitting people with lower age groups.

Important is to understand and question whether you have planned for such an eventuality – Do you have adequate medical insurance? Are your family members informed about the same? Have you created enough corpus to cater for such an eventuality? Have you created an emergency fund to fund such an eventuality?

The above-mentioned situations can happen to anyone, yes anyone. They are real situations, which can financial trap you. If you think, Nah! You are exceptional, believe me, you are not.

To fight these financial traps, you need a well prepared financial plan. A thoughtful financial plan will help you and your beloved ones to survive emotionally and financially in tough times.

Benefits of a well prepared financial plan –

- A strategic financial plan evaluates your financial value, your current cost of living and accordingly suggest you life insurance

- A thoughtful financial plan helps you make your will

- A financial plan will help your beloved ones stay informed about your investments and finances

- A financial plan will assist you with the right amount for health insurance as well

- A financial plan will guide you in creating an emergency reserve

Take time to look at your finances and find loopholes if any.

How will you prevent yourself from these financial traps?

To create a unique workable financial plan and to achieve your financial goals take advantage of our Money Multiplier (Money Multiplication) Workshop Now!!!

Deepak Dhabalia

Wealth Coach