MUST KNOW THINGS ABOUT MUTUAL FUNDS

#1 Does any type of mutual fund invests in a combination of stocks and bonds?

Yes. This is best done by balanced funds. Balanced funds invest in a combination of stocks and bonds. The balanced fund invests in a typical mix is 60:40 in favour of stocks. However, the returns from balanced funds are normally lower than pure equity mutual funds when markets. Balanced funds is a must go for investors who have no or little knowledge about asset allocation and yet want to invest in equities.

#2 How can I invest with a minimum amount?

It is quintessential to first plan out how you will allocate your assets based on your risk tolerance, and your experience and knowledge about the market. If you have risk appetite investing in equities mutual fund schemes can ensure high returns. Apart from equities, income mutual funds can also be a good alternative to fixed-income investment.

If you want to begin with a limited amount regular investing/SIP is a very good way to create a strong investment portfolio.

#3 How can I evaluate mutual funds performance?

The best way to evaluate the performance of a mutual fund is to assess its performance over a period of six months to a year in comparison to its stated objectives. Identify the top five performing funds over a year. Demonstrate its ability to be not only good but also consistent.

#4 How can I select a mutual fund scheme?

Investing in a mutual fund requires strategic input like in other investing instruments. However, in mutual funds its important for you to identify funds whose investment objectives match your asset allocation needs. You need to choose a mutual fund that meets your risk tolerance and your budget. Evaluate past performance and look for consistency. Although past performance is no guarantee of future performance, it is a useful way of assessing how well or badly a fund has performed in comparison to its stated objectives and peer group.

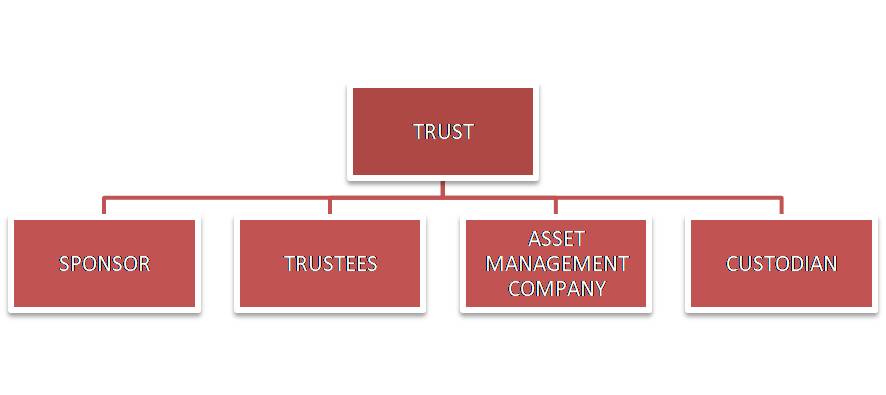

#5 How is a mutual fund set up?

The set up of a mutual fund is in the form of a trust. It comprises a Sponsor, Trustees, Asset Management Company (AMC) and Custodian. A Mutual FundTrust is started by a sponsor(s), who is a promoter of a company. The Mutual Fund Trustees hold its property for the benefit of the unitholders. Asset Management Company is approved by SEBI. It manages the funds by investing in various types of securities. The Mutual Fund Custodian is registered with SEBI. It holds the securities of various schemes of the fund in its custody.

SEBI Regulations states at least two-thirds of the directors of trustee company must be independent and that they should not be associated with the sponsors. It also states, approx. 50% of the directors of AMC must be independent. All mutual funds are required to be registered with SEBI before they launch any scheme.

#6 How is Net Asset Value calculated?

The value of all the securities in a mutual funds portfolio is calculated every day. From which, the expenses are subtracted. The resultant value divided by the number of units in the fund is the Net Asset Value (NAV).

#7 In the case of close-ended mutual fund schemes, how long does it take for transfer of units after purchase from stock markets?

As per SEBI Regulations, the units must be transferred within 30 days from the date of lodgement of certificates with the mutual fund.

#8 With how many funds or stocks should you diversify your portfolio?

With diversification, you can ensure maximum benefit while minimizing the risk on your mutual fund investments. Diversification enables you to spread your portfolio across different assets classes like fixed income, equity, infrastructure, gold etc.

There is no fixed rule as to how many assets you must include in your portfolio to diversify. However, it’s suggested to keep it simple and manageable. If you are a beginner start with balanced funds or you can even start with three Mutual Fund schemes for stocks and three schemes for Bonds.

#9 How significant is it to consider the fund costs while choosing a scheme?

The cost of investing through a mutual fund is very much significant, especially when if you are planning to invest in fixed income funds. As market norms, 1% towards management fees and 0.6% towards other annual expenses is acceptable. Also, understand the entry and exit loads.

#10 How to diversify your portfolio?

Don’t just boil in on one mutual fund. This will help you to avoid the risk of being overly dependent on just one fund. We would suggest you pick two, preferably three mutual funds that would match your investment objectives. We recommend a 60:40 split if you have shortlisted two funds and a 50:25:25 split if you have shortlisted three mutual funds for investment.